Renters Insurance in and around Owings Mills

Owings Mills renters, State Farm has insurance for you, too

Renters insurance can help protect your belongings

Would you like to create a personalized renters quote?

There’s No Place Like Home

Trying to sift through deductibles and savings options on top of managing your side business, your pickleball league and work, can be a lot to juggle. But your belongings in your rented space may need the incredible coverage that State Farm provides. So when mishaps occur, your sports equipment, pictures and furniture have protection.

Owings Mills renters, State Farm has insurance for you, too

Renters insurance can help protect your belongings

There's No Place Like Home

Renters insurance may seem like not a big deal, and you're wondering if you really need it. But take a moment to think about the cost of replacing all the personal property in your rented apartment. State Farm's Renters insurance can help when windstorms or tornadoes damage your personal property.

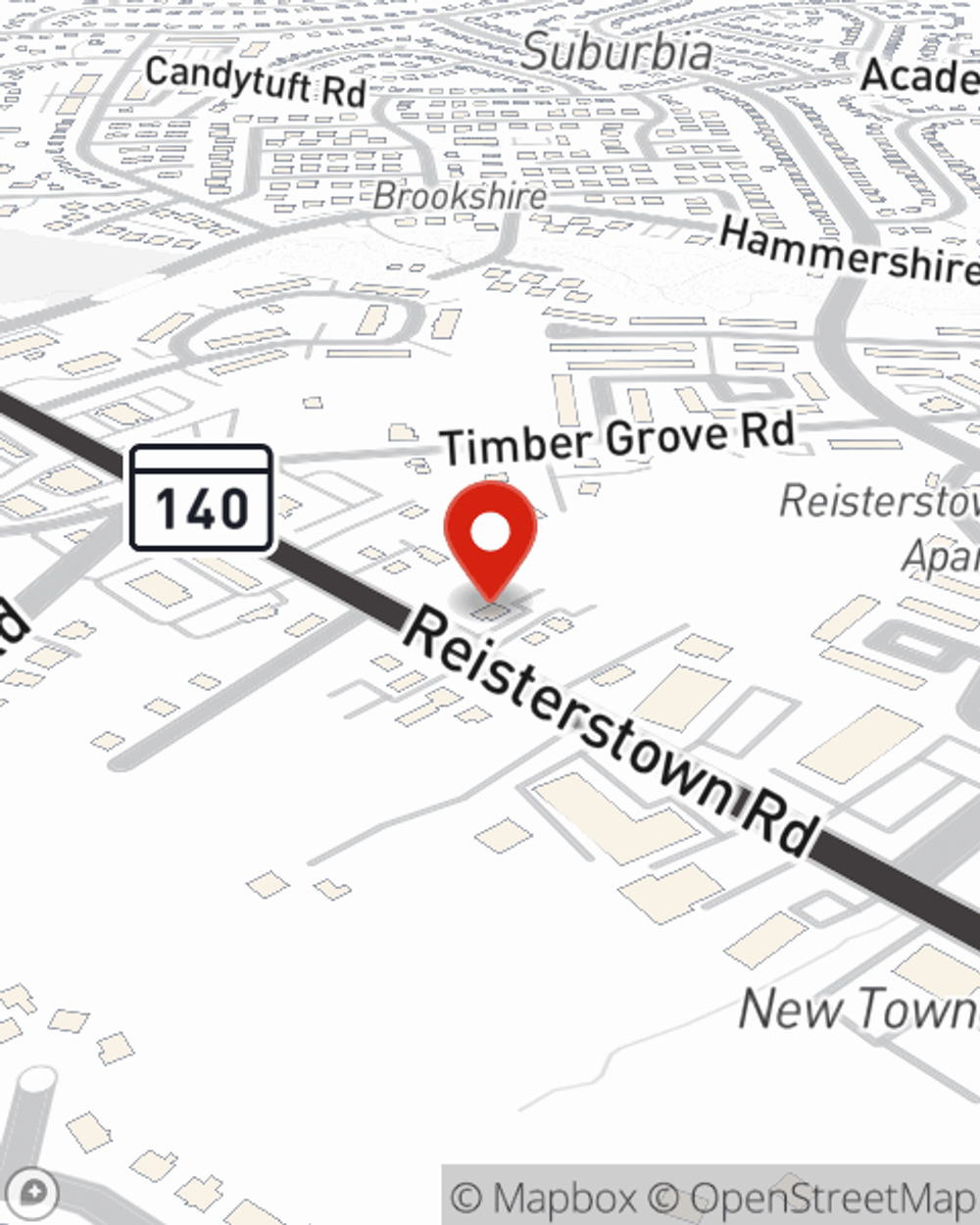

If you're looking for a dependable provider that can help with all your renters insurance needs, reach out to State Farm agent Ryan Hopkins today.

Have More Questions About Renters Insurance?

Call Ryan at (410) 363-0668 or visit our FAQ page.

Simple Insights®

How do I know how much renters insurance to buy?

How do I know how much renters insurance to buy?

For renters insurance, finding the right balance means choosing accurate, appropriate limits for your personal property and liability coverage.

DIY home improvement or hire a pro?

DIY home improvement or hire a pro?

Before jumping into a home improvement project, weigh the pros and cons of a DIY approach vs. hiring a professional contractor.

Ryan Hopkins

State Farm® Insurance AgentSimple Insights®

How do I know how much renters insurance to buy?

How do I know how much renters insurance to buy?

For renters insurance, finding the right balance means choosing accurate, appropriate limits for your personal property and liability coverage.

DIY home improvement or hire a pro?

DIY home improvement or hire a pro?

Before jumping into a home improvement project, weigh the pros and cons of a DIY approach vs. hiring a professional contractor.